The ultimate motive behind their calculation is to control costs and enhance improvement. The direct material quantity variance will be adverse if the actual quantity of fabric used in manufacturing 10,000 units of shirts is 30,000 meters and the standard amount of fabric allowed for a single shirt is 2.8 meters. A favorable materials quantity variance indicates savings in the use of direct materials.

Do you already work with a financial advisor?

- Direct material quantity variance is calculated to determine the efficiency of the production department in converting raw material to finished goods.

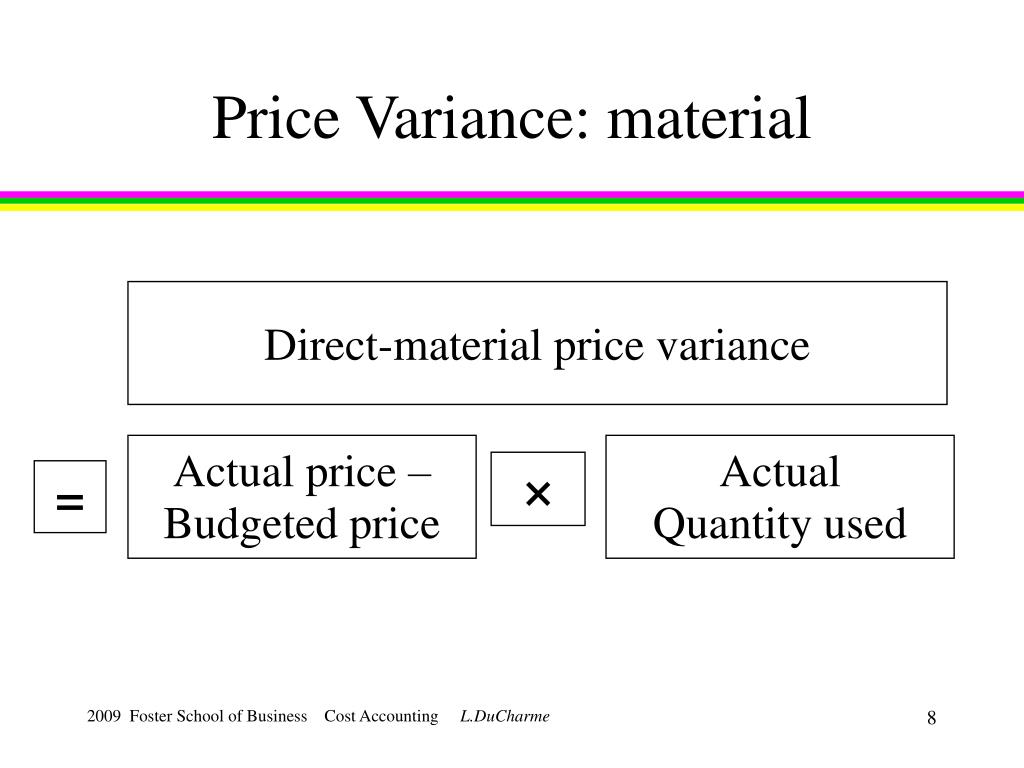

- To compute the direct materials price variance, subtract the actual cost of direct materials ($297,000) from the actual quantity of direct materials at standard price ($310,500).

- By delving into the specifics of variances, companies can uncover inefficiencies and make informed decisions to optimize their operations.

- At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

- This is the difference between the standard and actual cost per unit of the direct materials purchased, multiplied by the standard number of units expected to be used in the production process.

The difference between the two postings is the variance of -800, which is posted to the direct materials variance account as a debit representing the unfavorable variance. The difference in the quantity is multiplied by the standard price to determine that there was a $1,200 favorable direct materials quantity variance. The net direct materials cost variance is still $1,320 (unfavorable), but this additional analysis shows how the quantity and price differences contributed to the overall variance. Because the company uses 30,000 pounds of paper rather than the 28,000-pound standard, it loses an additional $20,700.

Direct materials quantity variance

An unfavorable variance, on the other hand, indicates that the amount of materials used exceeds the standard requirement. Internal factors, such as production efficiency and waste management, significantly affect material quantity variance. Inefficient production processes, outdated machinery, or inadequate employee training can result in higher know the facts about the fair tax material consumption than planned. Implementing lean manufacturing techniques, investing in modern equipment, and providing ongoing training for employees can enhance production efficiency and reduce material waste. Additionally, regular audits of the production process can identify areas for improvement and help maintain optimal material usage.

Direct Materials Quantity Variance: Definition

How much is the direct materials quantity variance of Prime Furniture Inc. for the month of December 2022? To begin with, calculating direct material variance involves comparing the standard cost of materials to the actual cost incurred. This comparison helps businesses understand whether they are spending more or less than anticipated on raw materials. The standard cost is typically derived from historical data, industry benchmarks, or predetermined budgets, while the actual cost is recorded during the production process. The variance is calculated using the direct materials quantity variance formula, which takes the difference between the standard quantity and the actual quantity, and multiplies this by the standard price per unit of material. This is the difference between the standard and actual cost per unit of the direct materials purchased, multiplied by the standard number of units expected to be used in the production process.

How confident are you in your long term financial plan?

This example illustrates the accounting entries for purchase price variance and exchange rate variance for a standard cost item. An adverse or unfavorable material quantity variance occurs when the actual volume of materials used in production exceeds the standard quantity that is expected for the level of output in a period. This involves looking beyond the numbers to understand the underlying factors contributing to the variances. For example, if a material price variance is detected, managers should examine market conditions, supplier performance, and procurement strategies to pinpoint the cause. Similarly, if a material quantity variance is found, a thorough review of the production process, employee performance, and equipment efficiency is necessary.

Favorable or unfavorable variance

The material quantity variance can yield unusual results, since it is based on a standard unit quantity that may not be even close to actual usage. The material quantity is usually set by the engineering department, and is based on an expected amount of material that should theoretically be used in the production process, along with an allowance for a reasonable amount of scrap. If the standard is excessively generous, there will be a long series of favorable material quantity variances, even though the production staff may not be doing an especially good job.

The difference between the standard cost of direct materials specified for production and the actual cost of direct materials used in production is known as Direct Material Cost Variance. Materials price variance (or direct materials price variance) is the part of materials cost variance that is attributable to the difference between the actual price paid and the standard price specified for direct materials. Premium Furniture, a US based Inc., uses a standard costing system to control its direct materials and conversion costs. During the month of December 2022, its workers used 3,750 feet of timber to finish 1,500 office chairs. The standard length of timber allowed to manufacture an office chair is 2.75 feet and the standard rate per foot of timber is $3.50.

If there wasn’t enough supply available of the necessary raw materials, the company purchasing agent may have been forced to buy a more expensive alternative. If the company bought a smaller quantity of raw materials, they may not have qualified for favorable bulk pricing rates. In other words, if the business has consumed fewer materials to produce a given level of output than expected, the material quantity variance is said to be favorable. The material quantity variance in this example is favorable because the company manufactured the output using a lesser quantity of materials than what was planned in the budget. Direct materials quantity variance is also known as direct material usage or volume variance.