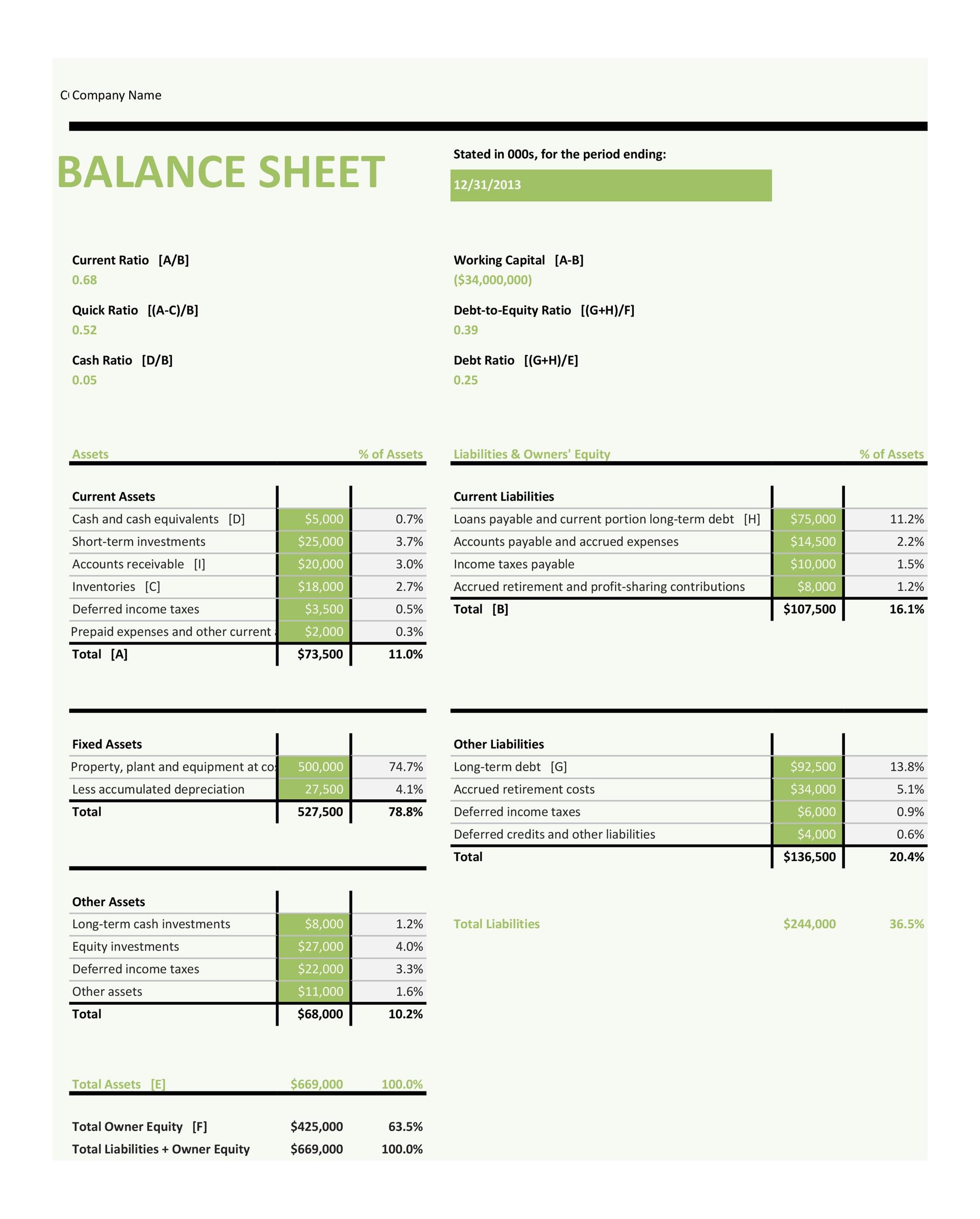

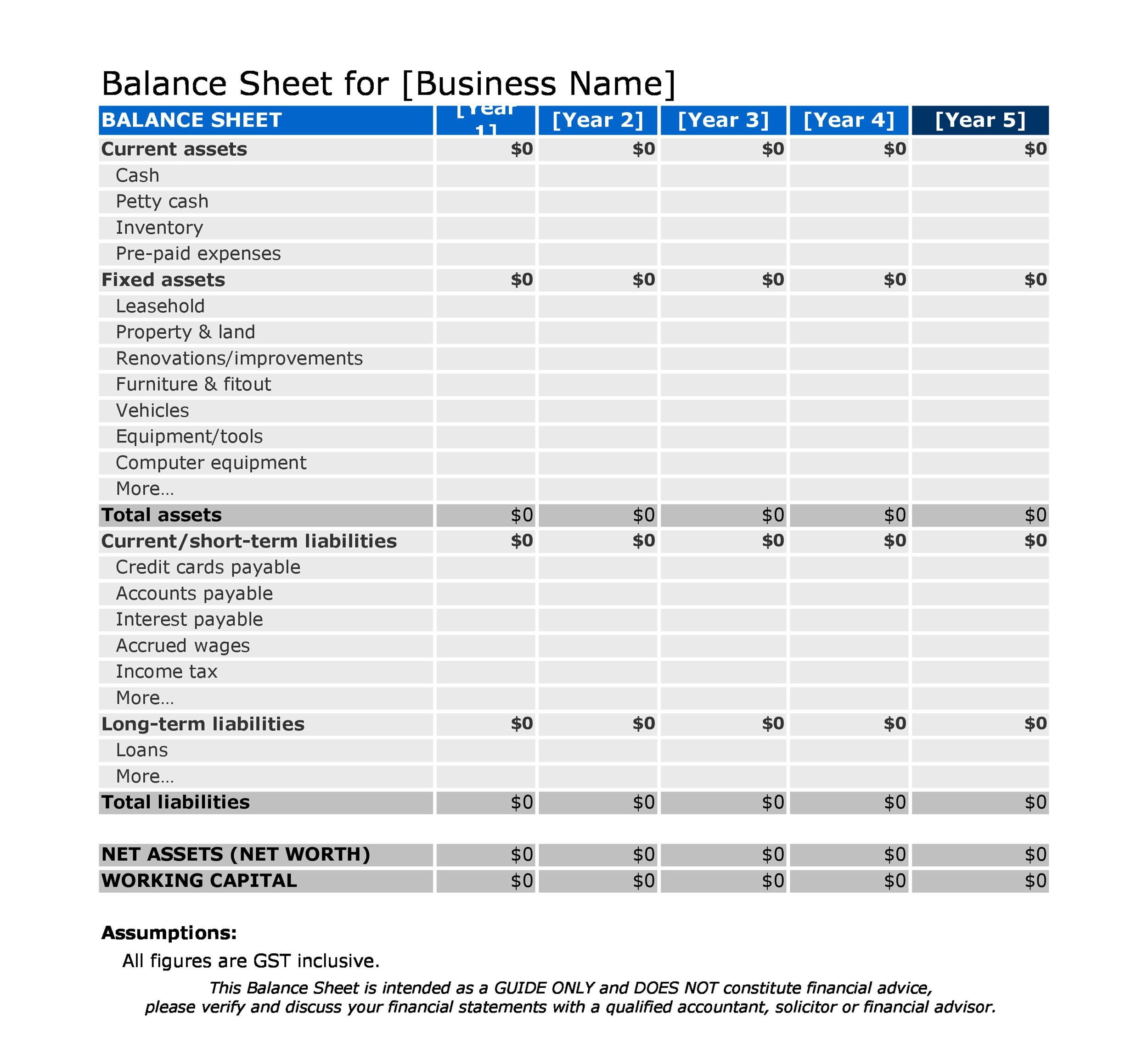

The balance sheet previews the total assets, liabilities, and shareholders’ equity of a company on a specific date, referred to as the reporting date. A balance sheet is a financial statement that shows the relationship between assets, liabilities, and shareholders’ equity of a company at a specific point in time. Most of the information about assets, liabilities, and owners’ equity items is obtained from the adjusted trial balance of the company.

Business

Updates to your application and enrollment status will be shown on your account page. We confirm enrollment eligibility within one week of your application for CORe and three weeks for CLIMB. HBS Online does not use race, gender, ethnicity, or any protected class as criteria for admissions for any HBS Online program. Updates to your enrollment status will be shown on your account page. HBS Online does not use race, gender, ethnicity, or any protected class as criteria for enrollment for any HBS Online program. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching.

Investment Property Balance Sheet Template

A balance sheet is an important reference document for investors and stakeholders for assessing a company’s financial status. This document gives detailed information about the assets and liabilities for a given time. By analysing balance sheet, company owners can keep their business on a good financial footing. In other words, it is the amount that can be handed over to shareholders after the debts have been paid and the assets have been liquidated. Equity is one of the most common ways to represent the net value of the company.

Submit to get your retirement-readiness report.

For mid-size private firms, they might be prepared internally and then looked over by an external accountant. Last, a balance sheet is subject to several areas of professional judgement that may materially impact the report. For example, accounts receivable must be continually assessed for impairment and adjusted to reflect potential uncollectible accounts. Without knowing which receivables a company is likely to actually receive, a company must make estimates and reflect their best guess as part of the balance sheet. The balance sheet provides an overview of the state of a company’s finances at a moment in time. It cannot give a sense of the trends playing out over a longer period on its own.

- Companies, organizations, and individuals use balance sheets to easily calculate their equity, profits, or net worth by subtracting their liabilities from their assets.

- Or you might compare current assets to current liabilities to make sure you’re able to meet upcoming payments.

- Our intuitive software automates the busywork with powerful tools and features designed to help you simplify your financial management and make informed business decisions.

- It records any money borrowed or loaned by the director to the business, as well as any personal expenses paid for by the company on behalf of the director.

- Current and non-current assets should both be subtotaled, and then totaled together.

Assets = Liabilities + Owner’s Equity

The ratio is calculated by dividing the total liabilities by the total equity. The Profit and Loss Statement or Income Statement shows a company’s income and expenses over a specific period, such as a month or year. The P&L can be used to see how your business is doing and making a profit or loss. Now that you have an idea of how values are recorded in several accounts in a balance sheet, you can take a closer look with an example of how to read a balance sheet.

Benefit that Statement of Financial Position Provide to Users

This simply lists the amount due to shareholders or officers of the company. In both formats, assets are categorized into current and long-term assets. xero shoes Current assets consist of resources that will be used in the current year, while long-term assets are resources lasting longer than one year.

It uses formulas to obtain insights into a company and its operations. Below is an example of a balance sheet of Tesla for 2021 taken from the U.S. Share capital is the value of what investors have invested in the company. To measure the money remaining in the company’s coffers after financing its activity. The resources are ordered according to whether or not they are due and payable. Detail of it could be found in the statement of change in equity and Noted to Financial Statements.

You also don’t include current assets that are harder to liquidate, like inventory. Because the balance sheet reflects every transaction since your company started, it reveals your business’s overall financial health. At a glance, you’ll know exactly how much money you’ve put in, or how much debt you’ve accumulated. Or you might compare current assets to current liabilities to make sure you’re able to meet upcoming payments. The Balance Sheet—or Statement of Financial Position—is a core financial statement that reports a snapshot of a company’s assets, liabilities, and shareholders’ equity at a particular point in time.