So let’s discuss what each of these are and we’ll see how this is always going to be true. As business transactions take place, the values of the accounting elements change. The accounting equation nonetheless always stays in balance. The accounting equation ensures that a company’s balance sheet remains balanced. It serves as a vital tool for financial analysis and reporting.

What Are the Key Components in the Accounting Equation?

Liabilities can also be classified as current or non-current. A liability is considered current of they are payable within 12 months from the end of the accounting period, or within the company’s normal operating cycle if the cycle exceeds 12 months. The accounting equation is a vital concept in accounting, underpinning financial reporting and analysis. Understanding it is crucial for anyone involved in finance. Cash (asset) will reduce by $10 due to Anushka using the cash belonging to the business to pay for her own personal expense.

Capital

It is central to understanding a key financial statement known as the balance sheet (sometimes called the statement of financial position). The following illustration for Edelweiss Corporation shows a variety of assets that are reported at a total of $895,000. Creditors are owed $175,000, leaving $720,000 of stockholders’ equity. So now we’re on the right hand side of the equation, right?

- Under the accrual basis of accounting, expenses are matched with revenues on the income statement when the expenses expire or title has transferred to the buyer, rather than at the time when expenses are paid.

- This includes expense reports, cash flow and salary and company investments.

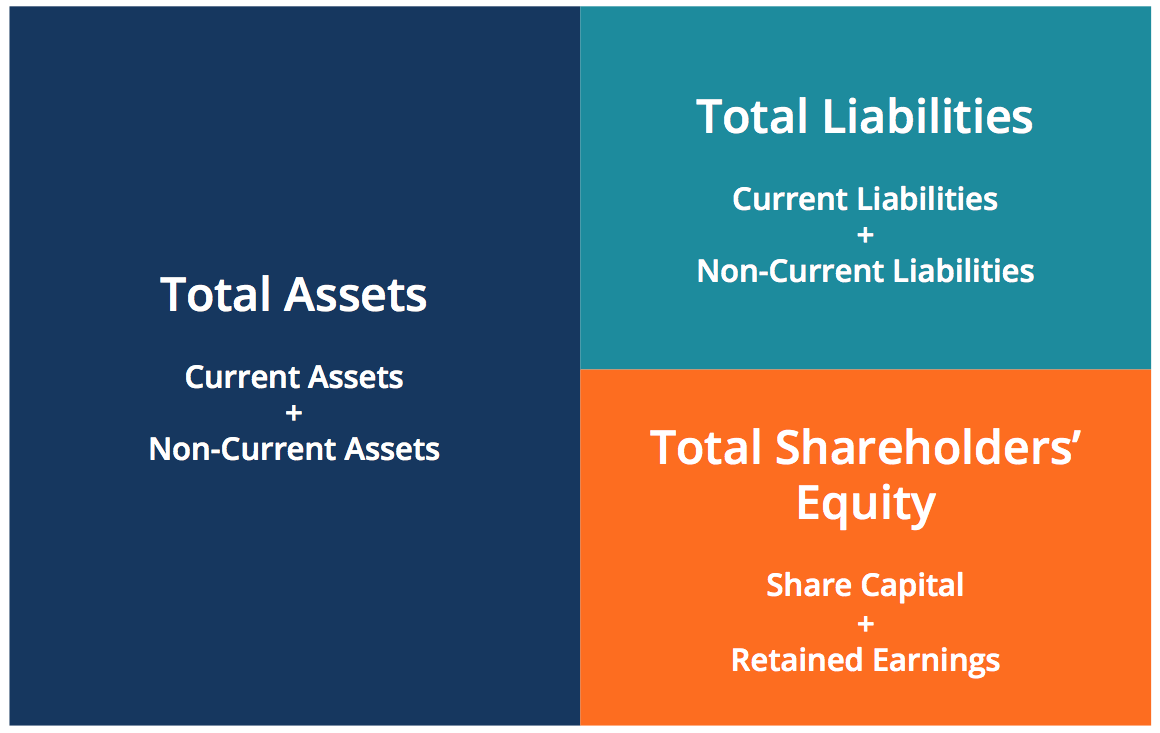

- The accounting equation shows the amount of resources available to a business on the left side (Assets) and those who have a claim on those resources on the right side (Liabilities + Equity).

- Because many assets are not reported at current value.

- Similarly, the business may have unrecorded resources, such as a trade secret or a brand name that allows it to earn extraordinary profits.

Liabilities

To learn more about the balance sheet, see our Balance Sheet Outline. Drawings are amounts taken out of the business by the business owner. They will therefore result in a reduction in capital.

Applications in Financial Reporting

In other words, this equation allows businesses to determine revenue as well as prepare a statement of retained earnings. This then allows them to predict future profit trends and adjust business practices accordingly. Thus, the accounting equation is an essential step in determining company profitability. For a company keeping accurate accounts, every business transaction will be represented in at least two of its accounts. For instance, if a business takes a loan from a bank, the borrowed money will be reflected in its balance sheet as both an increase in the company’s assets and an increase in its loan liability. The accounting equation states that a company’s total assets are equal to the sum of its liabilities and its shareholders’ equity.

For example, when a company borrows money from a bank, the company’s assets will increase and its liabilities will increase by the same amount. When a company purchases inventory for cash, one asset will increase and one asset will decrease. Because there are two or more accounts affected by every transaction, the accounting system is referred to as the double-entry accounting or bookkeeping system. The accounting equation is the backbone of the accounting and reporting system.

Think of retained earnings as savings, since it represents the total profits that have been saved and put aside (or “retained”) for future use. Assets include cash and cash equivalents or top 9 things you should know about agile product delivery liquid assets, which may include Treasury bills and certificates of deposit (CDs). CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation.

Assets will always equal liabilities and owner’s equity. As expected, the sum of liabilities and equity is equal to $9350, matching the total value of assets. So, as long as you account for everything correctly, the accounting equation will always balance no matter how many transactions are involved. Since the balance sheet is founded on the principles of the accounting equation, this equation can also be said to be responsible for estimating the net worth of an entire company.

He is the sole author of all the materials on AccountingCoach.com. Parts 2 – 6 illustrate transactions involving a sole proprietorship.Parts 7 – 10 illustrate almost identical transactions as they would take place in a corporation.Click here to skip to Part 7. For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. The global adherence to the double-entry accounting system makes the account-keeping and -tallying processes more standardized and foolproof.

CFI is on a mission to enable anyone to be a great financial analyst and have a great career path. In order to help you advance your career, CFI has compiled many resources to assist you along the path. In other words, all assets initially come from liabilities and owners’ contributions.